The Staff Selection Commission (SSC) has officially activated the SSC CGL Tier 1 Answer Key 2025 link on its website ssc.gov.in. Candidates who appeared for the examination can now download their response sheets and answer keys to verify their answers and calculate their tentative scores. The objection window is open until 19 October 2025, allowing candidates to challenge any discrepancies found in the provisional answer key.

SSC CGL Answer Key 2025 Out

The SSC CGL Tier 1 Answer Key 2025 has been officially released, and the link is active now. Candidates can review their responses and raise objections against any provisional answers. The objection window is opened and active till 19 October 2025 (09:00 PM), with a fee of ₹50 per question for each challenge submitted. After reviewing all objections, the final answer key and Tier 1 results will be published on the official SSC website.

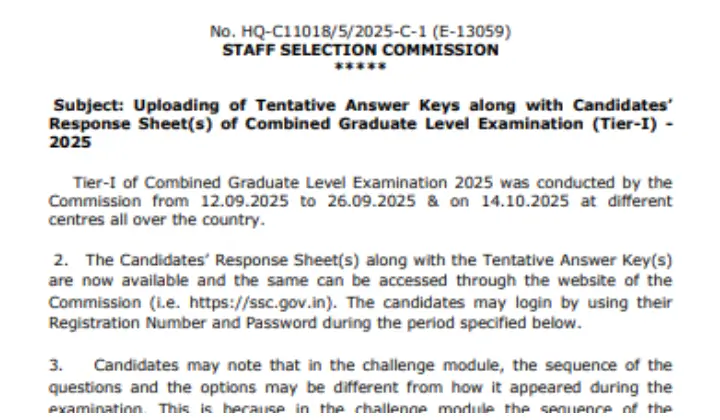

SSC CGL Answer Key 2025: Notice PDF

SSC CGL 2025 Response Sheet

Aspirants are advised to carefully review their responses and submit objections, if necessary, before the deadline. Below is a quick view of key information about the SSC CGL Tier 1 Answer Key 2025. Candidates can use this to check details like exam dates, vacancies, and how to download their response sheets.

| Particulars | Details |

| Board |

Staff Selection Commission (SSC)

|

| Posts | Group B & Group C |

| Exam Name |

SSC Combined Graduate Level (CGL) 2025

|

| Vacancies | 14,582 |

| Tier 1 Exam Dates | 12 to 26 September 2025 |

| Answer Key Release Date | 16 October 2025 |

| Last Date to Download Answer Key | 19 October 2025 |

| Raise Objections | till 19 October 2025 (09:00 PM) |

| Payment for Objection | ₹50/- per question |

| Selection Process | Tier 1 → Tier 2 |

| Official Website | www.ssc.gov.in |

SSC CGL Answer Key 2025 Download Link

The SSC CGL 2025 Phase 1 Answer Key has now been released and is live on the official website ssc.gov.in. Candidates can download the complete answer key, which includes each question ID along with the correct options, to compare their responses and estimate their probable scores. In case of any discrepancies, candidates can raise objections within the specified dates by paying the prescribed fee per question.

SSC Answer Key 2025: Link Will be Active Soon

How many candidates will be selected for SSC CGL Tier 2 Exam 2025?

Candidates who qualify in the SSC CGL Tier 1 Exam 2025 will be eligible for Tier 2. The exact number of candidates selected depends on the official cut-off and merit list.

SSC CGL Answer Key Marks Calculation

To calculate your marks using the SSC CGL Tier 1 Answer Key 2025, candidates need to compare their answers with the official key. Each correct answer carries 2 marks, while 0.50 marks are deducted for every wrong answer. Unattempted questions do not affect the score.

Example:

Total Questions Attempted: 80

Correct Answers: 65 × 2 = 130 marks

Incorrect Answers: 15 × 0.50 = 7.5 marks

Estimated Score = 130 – 7.5 = 122.5 marks

By following this calculation, candidates can get an approximate idea of their Tier 1 performance before the final results are announced.

Note: The marks calculated here are provisional. Final scores will be determined after normalization across all shifts/sessions.

Qualifying Marks for SSC CGL 2025 Tier 1

The SSC CGL 2025 Tier‑1 Exam serves as a qualifying round, meaning your performance here doesn’t directly impact your final selection but determines eligibility for the next stage. The normalization process adjusts scores across different shifts to ensure fairness, accounting for variations in difficulty levels. At last, the final selection depends on your performance in Tier‑2 and subsequent stages, not just Tier‑1.

| Category | Minimum Qualifying Marks |

| General | 30% |

| OBC & EWS | 25% |

| SC/ST/PH | 20% |

Can I challenge the SSC CGL Tier 1 Answer Key 2025?

Yes, SSC allows candidates to raise objections against the provisional answer key within a specified period. You must submit valid proof and pay the prescribed objection fee for each challenged question.

Objection Raise Link for SSC CGL Tier 1 Answer Key 2025

Candidates who find any discrepancies in the SSC CGL Tier 1 Answer Key 2025 can raise objections online through the official website, ssc.gov.in. To submit an objection, candidates should log in using their registered ID and password, navigate to the “Answer Key Challenge” section, and select the question(s) they wish to challenge. After entering the necessary details and uploading relevant evidence, complete the process by making the payment online.

SSC Answer Key Objection Link 2025

How to Raise Objections Against SSC CGL Tier 1 Answer Key 2025

If you find any incorrect answers in the SSC CGL Tier 1 Answer Key 2025, you have the option to raise objections online till 19 October 2025 by paying ₹50/- per question.

- Visit the Official Website

Go to ssc.gov.in

and log in using your User ID and Password. - Click on ‘Answer Key Challenge’

Once logged in, look for the ‘Answer Key Challenge’ link and click on it. - Pay the Objection Fee

The fee is usually Rs. 100 per question.

You will be redirected to an online payment page.

Example: For 2 questions, you’ll pay Rs. 200. - Fill in Objection Details

Enter your name, mobile number, question number, correct option (as per you) and reason (within 300 characters).

Also, write a short reason (within 300 characters) for challenging the answer. - Submit the Objection

After entering all details, click Submit to complete the process.

How many candidates are expected to qualify for SSC CGL Tier 2 2025?

The number of candidates shortlisted for Tier 2 depends on the overall performance and cut-off marks. Generally, SSC selects approximately 8 to 10 times the number of vacancies for the next stage.

What After SSC CGL Answer Key 2025?

After the release of the SSC CGL Tier 1 Answer Key 2025, candidates can review their responses and estimate their scores. This stage plays a crucial role in helping aspirants understand their performance before results are declared.

- Review Your Answers and Calculate Scores: Once the answer key is available, candidates should download it from the official SSC website and compare their marked answers. Using the official marking scheme, they can calculate their estimated marks and predict their chances of qualifying for Tier 2.

- Raise Objections (If Necessary): If candidates find any discrepancies in the provisional answer key, they can challenge it within the specified objection window. Each objection must be supported with valid proof and submitted along with the prescribed fee.

- Wait for the Final Answer Key and Tier 1 Result: After evaluating all objections, SSC will release the final answer key along with the Tier 1 results. The result will include the list of candidates shortlisted for the next phase- SSC CGL Tier 2.

- Prepare for SSC CGL Tier 2 Examination: Candidates who qualify Tier 1 should start revising important topics for Tier 2 immediately. The next stage is crucial, as it determines the final selection for various Group B and Group C posts.

When will the SSC CGL Result 2025 be Released?

The Staff Selection Commission (SSC) is expected to declare the SSC CGL Tier 1 Result 2025 in November 2025, most likely during the third week. This follows the completion of answer sheet evaluation and consideration of objections raised against the provisional answer key. The results will be available on the official SSC website, allowing candidates to check the merit list and their qualifying status. Clearing Tier 1 is a crucial step for aspirants to progress to the Tier 2 examination and continue in the selection process.

SSC CGL 2025 Cutoff Marks

The SSC CGL 2025 cutoff marks will be released along with the Tier 1 results, expected in November 2025. These SSC CGL Prelims Cut Offs represent the minimum marks candidates must secure to qualify for Tier 2. Candidates are advised to regularly check the official SSC website for updates and details regarding the cutoff and qualifying criteria.

SBI Clerk Answer Key 2025 Soon, Check Me...

SBI Clerk Answer Key 2025 Soon, Check Me...

UPSC EPFO Answer Key 2025, Check Answers...

UPSC EPFO Answer Key 2025, Check Answers...

IB Security Assistant Answer Key 2025 Ou...

IB Security Assistant Answer Key 2025 Ou...