Reasoning Questions for SBI PO Prelims 2019

Directions (1-5): Study the following information carefully and answer the questions given below-

R sits second to the right of the one who likes Blue colour. Only two persons sits between R and V who likes blue colour. Q likes either white or yellow colour and sits third to the left of the one who sits second to the left of W. R sits second to the left of the one who like white colour. T and W faces each other and both of them likes same colour. U sits second to the right of the one who likes white colour and immediate right of the one who likes blue colour. T likes either white or yellow. P likes yellow colour and is not an immediate neighbour of R. U likes blue colour.

Ten persons A, B, C, D, E, P, Q, R, S and T are going for vacations on two different dates i.e. 15th and 20th of five months viz. March, April, July, August and September.

Four persons goes between C and E, who goes after C. T goes on vacation on one of the months before C. Both C and T goes in the same date. Two persons goes between B and T. Q goes on vacation in one of the months which has 30 days but not on 20th. D goes immediately after T. Four persons goes between A and S. S goes on vacation before R and after P.

Q6. Who among the following goes on 15th April?

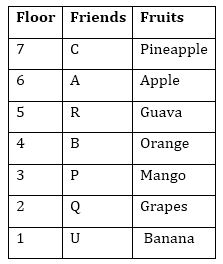

There are seven friends A, B, C, P, Q, R and U. They live on 7 different floors of a building; lowermost floor is numbered 1 and topmost floor is numbered 7. Also, they like different fruits i.e. Grapes, Banana, Pineapple, Mango, Orange, Guava, and Apple but not necessarily in the same order.

A lives just above R but not on 2nd floor. P lives immediately below the one who likes Orange and he likes Mango. U lives on odd numbered floor and likes Banana. B lives on 4th floor and likes Orange. A likes Apple and R likes Guava. C lives on odd numbered floor above 4th floor and likes Pineapple. R doesn’t live on even numbered floor.

Q11. Who among the following lives on 3rd floor?

C

Q21. If in each number first digit is replaced by the second digit, second digit is replaced by the third digit and third digit is replaced by the first digit, then which number will be the second lowest?

625

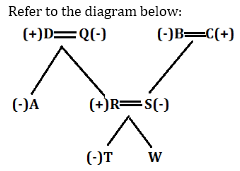

A, B, C, D, Q, R, S, T and W are nine persons living in the same house. There are three married couple in the house. A is the only daughter of D, who is the paternal grandfather of T. R is the son of Q. T is the daughter of S. B is the mother of S. B is not married to D. C is the maternal grandfather of T. R is the father of T. T is sister of W.

Q26. How is A related to S?

Mother in-law

Q29. If 2 is subtracted from each even number and 1 is added to each odd number in the number 4375268, then which among the following digits will appear twice in the new number thus formed?

Ten persons are sitting in two parallel rows facing each other. A, B, C, D and E are sitting in row 1 facing north and P, Q, R, S and T are sitting in row 2 facing south (not necessarily in the same order). The persons who are facing each other likes same sports. The sports are Cricket, Football, Hockey, Tennis and Badminton.

B sits third to the right of E and one of them sits at an extreme end of the row. One person sit between S and P and neither of them sits at any end. The pair who likes Badminton sits to the immediate left of B. T sits at one of the end and does not like Football. C sits second to the right of E. S likes Cricket. D likes football and sits at one of the end. Q does not like Football. Either of the pair who sits at the extreme ends does not like Hockey. The pair who likes Tennis does not sit to the immediate right of P. Q does not face A.

Q31. Who among the following sits to the immediate right of the one who faces D?

S

- Check the Study related Articles Here

- Study Notes for All Banking Exams 2018

- Bankers Adda Daily Questions for SBI PO, IBPS PO Clerk & Bank Exams

NABARD Development Assistant Exam Analys...

NABARD Development Assistant Exam Analys...

SEBI Grade A Phase 2 Exam Analysis 2026

SEBI Grade A Phase 2 Exam Analysis 2026

NABARD DA Exam Analysis 2026, Shift 2, 2...

NABARD DA Exam Analysis 2026, Shift 2, 2...