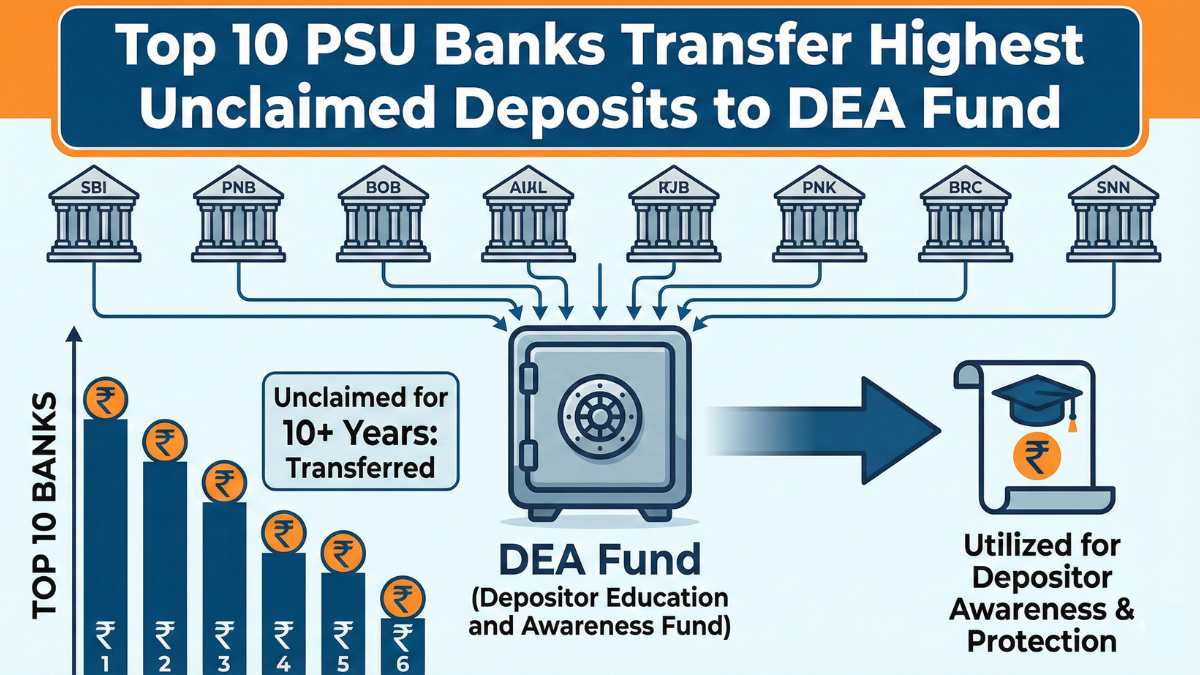

The top 10 public sector banks (PSBs) with the highest unclaimed deposits transferred to the RBI’s Depositor Education and Awareness (DEA) Fund are led by State Bank of India, followed by Punjab National Bank, Canara Bank, Bank of Baroda, and Union Bank of India as of June 30, 2025. Together, these 10 PSBs have transferred tens of thousands of crores of unclaimed deposits, reflecting both the scale of India’s banking system and the challenge of tracking inactive accounts.

Top 10 PSU Banks Transfer Highest Unclaimed Deposits to DEA Fund

Unclaimed deposits are balances in bank accounts where no customer-initiated transaction has taken place for 10 years or more, after which banks must classify them as “unclaimed”. In India, such deposits are not kept by banks indefinitely; instead, they are transferred to the Depositor Education and Awareness (DEA) Fund managed by the Reserve Bank of India (RBI) under the DEA Fund Scheme, 2014.

The Finance Ministry has informed Parliament that public sector banks have transferred more than ₹45,000 crore of unclaimed deposits to the DEA Fund between 2019-20 and 2024-25 (up to 31 December 2024). Overall, 12 PSBs together have transferred about ₹58,331 crore of unclaimed deposits to the DEA Fund, highlighting the large stock of idle money lying in old or forgotten accounts.

Top 10 PSBs with the Highest Unclaimed Deposits

As per RBI data cited in Parliament, the following are the top 10 public sector banks with the highest amounts of unclaimed deposits transferred to the DEA Fund as of June 30, 2025.

| Rank | Public Sector Bank | Unclaimed Deposits Transferred |

| 1 | State Bank of India | ₹19,330 crore |

| 2 | Punjab National Bank | ₹6,911 crore |

| 3 | Canara Bank | ₹6,278 crore |

| 4 | Bank of Baroda | ₹5,277 crore |

| 5 | Union Bank of India | ₹5,105 crore |

| 6 | Bank of India | ₹3,934 crore |

| 7 | Indian Bank | ₹3,740 crore |

| 8 | Indian Overseas Bank | ₹2,386 crore |

| 9 | Central Bank of India | ₹2,092 crore |

| 10 | UCO Bank | ₹1,312 crore |

Process of Transfer and Claim

The process of transfer to the DEA Fund follows a clear compliance framework set by RBI.

- First, banks mark an account as dormant or inoperative after two years of inactivity; if no customer-initiated transaction occurs for ten years, the balance is treated as unclaimed.

- During the last five working days of each month, banks transfer the balances of such unclaimed accounts to the DEA Fund via the DEA Fund Services module.

- If a depositor or heir later appears with valid documents, the bank verifies the claim and then seeks reimbursement from the DEA Fund in the first ten working days of the following month through a consolidated claim.

Government and RBI Measures (UDGAM, Awareness)

To reduce the growing stock of unclaimed deposits, the RBI and the Government have launched several initiatives.

- The RBI launched the UDGAM portal (Unclaimed Deposits – Gateway to Access Information) in 2023, allowing customers to search for unclaimed deposits across multiple banks using simple details like name and bank.

- Banks and RBI run awareness campaigns urging customers to keep accounts active, update KYC details, add nominees and consolidate idle balances.

- PSBs have been instructed to proactively reach out to customers with dormant accounts through SMS, email, and letters before categorising funds as unclaimed and transferring them to the DEA Fund.

SBI Clerk Mains Cut Off 2025-26, Check E...

SBI Clerk Mains Cut Off 2025-26, Check E...

SBI Clerk Mains Result 2025-26 Out at sb...

SBI Clerk Mains Result 2025-26 Out at sb...

NABARD Grade A Mains Result 2026 Out at ...

NABARD Grade A Mains Result 2026 Out at ...