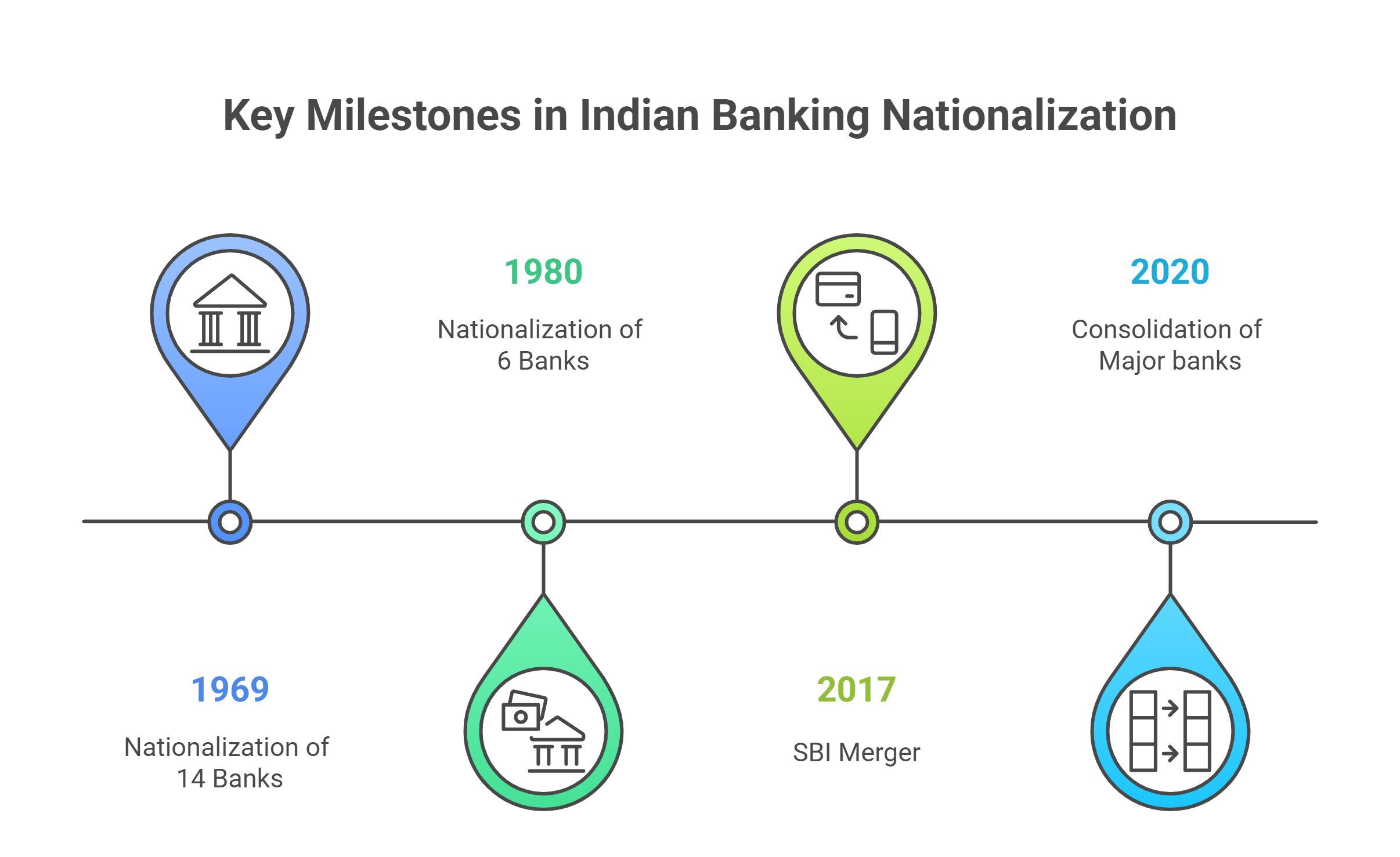

India’s banking sector has been a key part of the country’s economic growth and development since 1969. This Independence Day, it is important to remember the journey of India’s banks from the major Bank Nationalization under Prime Minister Indira Gandhi to the modern-era mergers that made public sector banks stronger and more efficient.

Bank Nationalization Day

Over the years, banks have made financial services accessible to both rural and urban areas, helping millions of people, small businesses, and the economy grow. The 1969 nationalization brought banking to many who had no access before, turning it into a tool for social and economic progress. Here are the major banks that were nationalized.

| Phase | Year | No. of Banks Nationalized | Name of Major Banks Nationalized |

| 1st Phase | 1969 | 14 Banks | Bank of India, Bank of Baroda, Punjab National Bank, Canara Bank, Indian Bank, Union Bank of India, and others |

| 2nd Phase | 1980 | 6 Banks | Andhra Bank, Corporation Bank, New Bank of India, Oriental Bank of Commerce, Punjab & Sind Bank, Vijaya Bank |

| SBI Merger | 2017 | 5 Associate Banks + BMB | State Bank of Bikaner & Jaipur, State Bank of Patiala, State Bank of Mysore, State Bank of Travancore, State Bank of Hyderabad, Bharatiya Mahila Bank |

| Mega Merger | 2020 | 10 Banks merged into 4 | – PNB + OBC + United Bank of India – Canara Bank + Syndicate Bank – Union Bank + Andhra + Corporation Bank – Indian Bank + Allahabad Bank |

1969 Nationalization (14 Banks)

Prior to 1969, India’s banking network was concentrated mainly in cities, catering predominantly to large corporations and affluent sections of society. Rural communities and small borrowers had little to no access to organized banking. To address this imbalance and extend financial services to all, the government undertook the bold step of nationalizing 14 prominent private banks, each holding deposits of over ₹50 crores.

Institutions such as Bank of India, Punjab National Bank, Bank of Baroda, and Canara Bank were brought under state control, marking a turning point toward a more inclusive and development-focused banking system.

Impact of the 1969 Nationalization

The results of the 1969 nationalization were transformational:

Branch Expansion: Bank branches increased significantly in rural and semi-urban areas. Between 1969 and 1990, rural branches grew from around 1,800 to over 35,000.

Increased Financial Inclusion: Millions of people gained access to banking facilities, including savings accounts, loans, and financial services.

Directed Lending: Banks were mandated to lend to priority sectors like agriculture, MSMEs, and weaker sections, ensuring credit was no longer monopolized by large industries.

Economic Empowerment: Nationalization empowered low-income households and small entrepreneurs by enabling access to formal credit systems.

The Second Phase of Nationalization, 1980 (6 Banks)

Following the success of the 1969 move, a second wave of nationalization occurred in 1980, when 6 more private sector banks were brought under government control. With this, the number of public sector banks increased to 20, further deepening financial penetration in underserved regions. These were:

- Andhra Bank

- Corporation Bank

- New Bank of India

- Oriental Bank of Commerce

- Punjab & Sind Bank

- Vijaya Bank

Consolidation and Mergers: The Modern-Day Normalization

After decades of expanding public sector banks (PSBs), the Indian government initiated a new strategy post-2010, consolidation and normalization, to strengthen and streamline the banking system. Key Developments in the Bank Consolidation Era:

2017-2018: The government began efforts to merge smaller PSBs with stronger ones. In 2017, State Bank of India (SBI) merged with its five associate banks and Bharatiya Mahila Bank, making it one of the top 50 global banks.

2019 Announcements (Effective 2020): The government merged 10 public sector banks into 4, reducing the number of PSBs from 27 (in 2017) to 12 (by 2020).

- Punjab National Bank absorbed Oriental Bank of Commerce and United Bank of India.

- Canara Bank merged with Syndicate Bank.

- Union Bank of India took over Andhra Bank and Corporation Bank.

- Indian Bank merged with Allahabad Bank.

Rationale Behind Mergers: The normalization through mergers aimed to create larger, stronger, and more competitive banks with improved efficiency, capital adequacy, and lending capacity.

Banks Still in Existence Today

After bank consolidations between 2017 and 2020, many nationalized banks were merged. Here are the banks from the 1969 and 1980 batches that still operate independently or as merged entities:

| Nationalized Bank in India (in 2025) | ||

| Bank of Baroda | Bank of India | Bank of Maharashtra |

| Canara Bank | Central Bank of India | Indian Bank |

| Indian Overseas Bank | Punjab National Bank | Punjab & Sind Bank |

| State Bank of India | UCO Bank | Union Bank of India |

IBPS Clerk Recruitment 2025

The IBPS Clerk Recruitment 2025, officially called CRP-CSA XV, opens the door to 10,277 Clerk (Customer Service Associate) vacancies in 11 public sector banks across India. The notification was issued on 31 July 2025, with the online registration process running from 1 August to 21 August 2025.

Candidates will first appear for the Preliminary Examination on 4, 5, and 11 October 2025, and those who qualify will proceed to the Main Examination scheduled for 29th November 2025. This recruitment aims to bring skilled candidates into the banking sector while offering a secure and growth-oriented career path.

SBI Clerk Recruitment 2025

The SBI Clerk Recruitment 2025 invites applications for 6,589 Junior Associate (Customer Support & Sales) positions across various branches nationwide. The registration window is open from 6 August to 26 August 2025, giving aspiring candidates three weeks to submit their applications online. The selection process will begin with the Preliminary Examination in September 2025, followed by the Main Examination in November 2025. Shortlisted candidates will then undergo a Language Proficiency Test to complete the final stage of recruitment.

Bank of Baroda Office Assistant Memory B...

Bank of Baroda Office Assistant Memory B...

Bank of India Credit Officer Admit Card ...

Bank of India Credit Officer Admit Card ...

Bank of Baroda Peon Exam Analysis 2026, ...

Bank of Baroda Peon Exam Analysis 2026, ...