Quantitative Aptitude is one of the scoring sections of the bank examination. If you clear your basics and practice more and more quizzes and also follow a proper study plan, you can easily crack the exam. IBPS PO Exam is one of the most prestigious exams in the Banking Sector. 10th August 2020 IBPS PO Prelims Quiz Based on- Percentage and Ratio & Proportion.

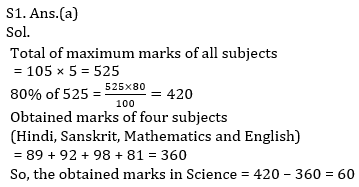

Q1. Nandita scored 80% marks in five subjects together Hindi, Science, Mathematics, English and Sanskrit, where the maximum marks of each subject were 105. How many marks did Nandita scored in Science, if she scored 89 marks in hindi 92 marks in Sanskrit, 98 marks in Mathematics and 81 marks in English?

(a) 60

(b) 75

(c) 65

(d) 70

(e) 80

Q2. A number is divided into two parts in such a way that 80% of 1st part is 3 more than 60% of 2nd part and 80% of 2nd part is 6 more than 90% of the 1st part. Then the number is:

(a) 125

(b) 130

(c) 135

(d) 145

(e) 155

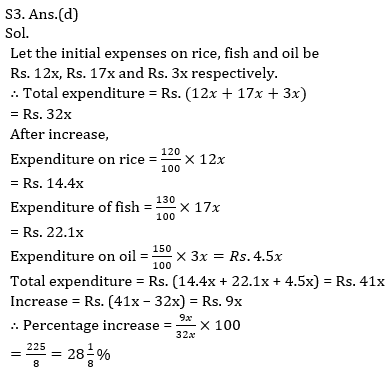

Q3. The expenses on rice, fish and oil of a family are in the ratio 12 : 17 : 3 respectively. The price of these articles is increased by 20%, 30% and 50% respectively. The total expenses increased by:

(a) 113/8 %

(b) 57/8 %

(c) 449/8 %

(d) 225/8 %

(e) None of these

Q4. The cost of a piece of diamond varies with the square of its weight. A diamond of Rs. 5184 value is cut into 3 pieces whose weights are in the ratio 1 : 2 : 3. Find the loss involved in the cutting.

(a) Rs. 3068

(b) Rs. 3088

(c) Rs. 3175

(d) Rs. 3168

(e) None of these

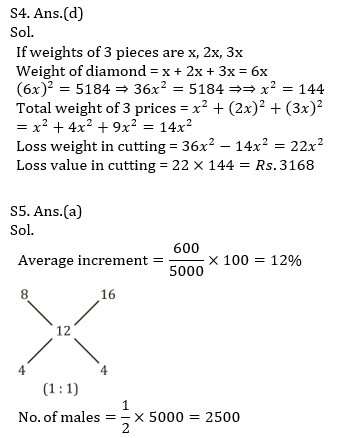

Q5. The total strength of capital Education is 5000. The number of males and females increases by 8% and 16% respectively and strength becomes 5600. What was the number of males at Capital Education?

(a) 2500

(b) 2000

(c) 3000

(d) 4000

(e) 4500

Q6. The rates of simple interest in two banks A and B are in the ratio 5 : 4. A person wants to deposit his total savings in these two banks in such a way that he receives equal half yearly interest from both. He should deposit the savings in banks A and B in the ratio:

(a) 2 : 5

(b) 4 : 5

(c) 5 : 2

(d) 5 : 4

(e) 3 : 5

Q7. One year ago the ratio between Laxman’s and Gopal’s salary was 3 : 4. The ratios of their individual salaries between last year’s and this year’s salaries are 4 : 5 and 2 : 3 respectively. At present the total of their salary is Rs. 4160. The salary of Laxman, now is:

(a) Rs. 1040

(b) Rs. 1600

(c) Rs. 2560

(d) Rs. 3120

(e) Rs. 4210

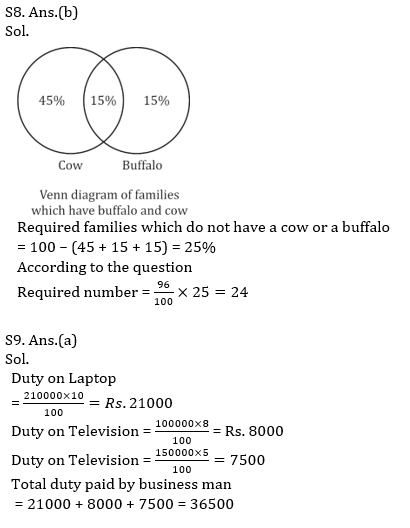

Q8. In a village, each of the 60% of families has a cow; each of the 30% of families has a buffalo and each of the 15% of families has both a cow and a buffalo. In all there are 96 families in the village. How many families do not have a cow or a buffalo?

(a) 20

(b) 24

(c) 26

(d) 17

(e) 28

Q9. A businessman imported Laptop, worth Rs. 210000, Mobile phones worth Rs. 100000 and Television sets worth Rs. 150000. He had to pay 10% duty on Laptops, 8% on phones and 5% on Television sets as special case. How much total duty (in rupees) he had to pay on all items as per above details?

(a) 36500

(b) 37000

(c) 37250

(d) 37500

(e) 42500

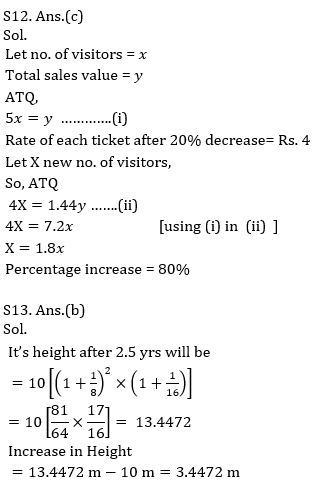

Q10. 60% students of a college study math, 55% students study commerce and 15% students study both. If ratio of boys to girl who study math only is 3 : 2 and ratio of boys to girls who study commerce only is 2 : 3, then total number of boys who study only math and only commerce together is what percent of total number of girls who study only math and only commerce together? (in approximate)

(a) 102%

(b) 109%

(c) 117%

(d) 123%

(e) 112%

Q11. Mr. Raghav owned a flat for Rs. 13.2 lacs. He spends 20% of his monthly salary on its paintings. 25% on lighting and furniture, 15% on foods and other supplements. If Mr. Raghav’s annual salary is 10.8 lacs then find the total spending made by Mr. Raghav.

(a) 137.4 lacs

(b) 1.374 lacs

(c) 13.74 lacs

(d) 11.74 lacs

(e) 17.34 lacs

Q12. The entrance ticket of an exhibition was Rs. 5. Later it was decreased by 20% and thus the sale amount is increased by 44%. What was the percentage increase in the number of visitors?

(a) 64%

(b) 24%

(c) 80%

(d) 20%

(e) 40%

Q13. A tree’s height increases annually by 1/8th of its height. By how much will its height increase after 2.5 years, if it stands today at 10 m height?

(a)3 m

(b)3.44 m

(c)3.6 m

(d)3.88 m

(e)4 m

Q14. A number X is less than another number Y. Number Y is three fourth of 24. Find the sum of the two numbers X and Y.

(a) 30

(b) 33

(c) 36

(d) 24

(e) 42

Q15. Udita purchased a hand bag in Rs. 2,520. Later she felt that she had given 5% extra of the actual price of hand bag. Find the actual price of hand bag.

(a) Rs. 2,646

(b) Rs. 2,500

(c) Rs. 2400

(d) Rs. 2,450

(e) None of these

Solutions

Download PDF for this Quiz

Practice with Crash Course and Online Test Series for IBPS PO Prelims:

Daily Current Affairs Quiz 7th February ...

Daily Current Affairs Quiz 7th February ...

OICL AO Cut Off 2026, Check Category-Wis...

OICL AO Cut Off 2026, Check Category-Wis...

SBI Clerk 3rd Waiting List Score Card 20...

SBI Clerk 3rd Waiting List Score Card 20...