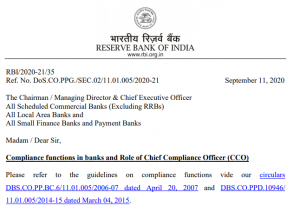

RBI has recently released a notice on Compliance Functions in Banks and the Role of Chief Compliance Officer (CCO), You should know about the Compliance functions in Banks and the Role of Chief Compliance Officer So that you can get a clear idea about these things. According to the compliance system Banks required, to have an effective compliance culture, independent corporate compliance function, and a strong compliance risk management programme at the bank and group level. Such an independent compliance function is required to be headed by a designated Chief Compliance Officer (CCO). Check here the details about Compliance Functions in Banks and the Role of Chief Compliance Officer (CCO).

The duties and responsibilities of the compliance function –

The motive of the compliance function is to help the bank in managing its compliance risk, which can be defined as the risk of legal or regulatory sanctions, financial loss, or loss to prominence a bank may suffer as a result of its failure to fulfill with all applicable laws, regulations, codes of conduct and standards of good practice (together, “laws, rules and standards”). Compliance risk is sometimes also introduced to as integrity risk because a bank’s prominence is closely connected with its adherence to principles of integrity and fair dealing. Banking supervisors must be satisfied that effective compliance policies and procedures are followed and that management takes appropriate corrective action when breaches of laws, rules, and standards are identified.

These shall include at least the following activities:

- To apprise the Board and senior management on regulations, rules, and standards, and any further developments.

- To provide clarification on any compliance-related issues.

- To conduct an assessment of the compliance risk (at least once a year) and to develop a risk-oriented activity plan for compliance assessment. The activity plan should be submitted to the ACB for approval and be made available to the internal audit.

- To report promptly to the Board / ACB / MD & CEO about any major changes/observations relating to the compliance risk.

- To periodically report on compliance failures/breaches to the Board/ACB and circulating to the concerned functional heads.

- To monitor and periodically test compliance by performing sufficient and representative compliance testing. The results of the compliance testing should be placed on Board/ACB/MD & CEO.

- To examine the sustenance of compliance as an integral part of compliance testing and annual compliance assessment exercise.

- To ensure compliance of Supervisory observations made by RBI and/or any other directions in both letter and spirit in a time-bound and sustainable manner.

Role of Chief Compliance Officer (CCO)

A Chief Compliance Officer (CCO) is a corporate official in charge of overseeing and managing compliance issues within the Bank, for example, that a bank is complying with regulatory requirements and that the company and its employees are complying with internal policies and procedures.

Role of the Chief Compliance Officer Includes following:

-

- Bank compliance officers are accountable for conducting audits and inspections to make sure a bank adheres to set internal and external laws.

- They are responsible for entails monitoring and analyzing risk areas in a bank’s operation to ensure observance of state or federal laws.

- Bank compliance officers assess policies/procedures and ensure they are in line with all regulations on mortgage and customer deposits.

- The research established banking laws to ensure the non-violation of federal laws.

- They also implement and adjust to new regulations passed by state or federal government bodies.

- As part of their work description, CCO officers give compliance advice to the risk management unit of an organization.

- They cooperate with the bank chief operating officer to ensure proper implementation of compliance policies.

- They also carry out research to stay abreast of public interest and consumer protection laws.

- The role of compliance officers in banks also involves taking care of the training of newly recruited personnel and bank staff.

- They conduct audits to spot areas of non-compliance and initiate solutions to address identified risks.

- They also plan and execute compliance programs to educate bank staff on new regulations.

Click Here to Register for Bank Exams 2020 Preparation Material

Visit Achieversadda.com and participate in discussions with other aspirants and achievers. Get answers to your queries and connect with others on Achieversadda.com

Practice With,

Weekly Current Affairs One Liners 23rd t...

Weekly Current Affairs One Liners 23rd t...

CSIR CRRI Typing Test 2025 Date for JSA ...

CSIR CRRI Typing Test 2025 Date for JSA ...

Can Final Year Students Apply for SBI PO...

Can Final Year Students Apply for SBI PO...