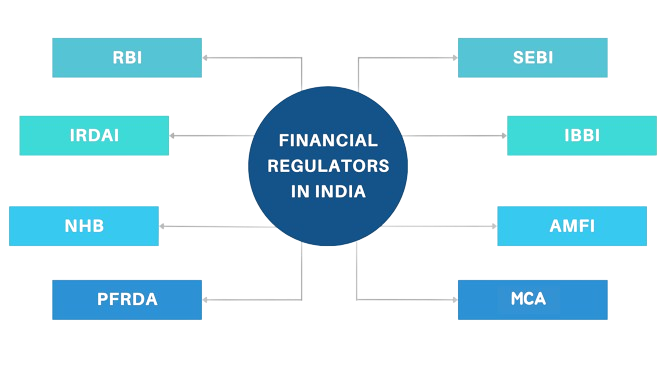

India’s financial system is regulated by a well-conditioned framework designed by Financial Regulators to ensure smooth functioning, maintain stability, and protect the interest of consumers. A particular regulatory body oversees a particular aspect of the financial sector in India, each playing a crucial role in maintaining order and Promoting growth.

What is a financial institution?

Well! any organization that deals in money is a financial institution. We will be discussing each one of them because it is one of the important topics from the exam point of view as well as from the interview point of view.

Financial Regulators in India

| Financial Regulators in India | |||

| Institution | Establishment Year | Head/ Chairman | Headquarter |

| RBI (Reserve Bank of India) | 1935 | Shaktikanta Das | Mumbai |

| SEBI (Securities Exchange Board of India) | 1992 | Madhabi Puri Buch | Mumbai |

| IRDAI (Insurance Regulatory & Development Authority of India) | 1999 | Debashish Panda | Hyderabad |

| IBBI (Insolvency & Bankruptcy Board of India) | 2016 | Ravi Mittal | New Delhi |

| NHB (National Housing Bank) | 1988 | Sanjay Shukla | New Delhi |

| AMFI (Association of Mutual Funds in India) | 1955 | Navneet Munot | Mumbai |

| PFRDA (Pension Fund Regulatory & Development Authority) | 2003 | Deepak Mohanty | New Delhi |

| MCA (Ministry of Corporate Affairs) | – | Nirmala Sitharaman | New Delhi |

Functions of Financial Regulators

The key function of these financial regulators in India is to oversee various segments of the economy, including banking, securities, insurance, pensions, mutual funds, and commodities.

Reserve Bank of India

- Monetary Authority: The RBI formulates and implements monetary policy to maintain price stability and ensure adequate flow of credit to productive sectors.

- Regulator of Financial System: It regulates and supervises financial institutions and banks to ensure financial stability and public confidence in the banking system.

- Issuer of Currency: The RBI has the sole right to issue currency notes in India.

- Foreign Exchange Management: It manages the Foreign Exchange Management Act, 1999, facilitating external trade and payments and promoting orderly development of the foreign exchange market.

- Developmental Role: The RBI undertakes initiatives to promote financial inclusion and literacy.

Securities Exchange Board of India (SEBI)

- Market Regulator: SEBI regulates the securities market to protect the interests of investors and to promote the development of, and regulate, the securities market.

- Investor Protection: It enforces regulations and takes steps to prevent malpractices in the securities market.

- Regulatory Oversight: SEBI oversees the activities of market intermediaries like brokers, underwriters, and mutual funds, ensuring they adhere to regulatory standards.

Insurance Regulatory and Development Authority of India (IRDAI)

- Regulation of the Insurance Industry: IRDAI regulates and promotes the insurance and re-insurance industries in India.

- Policyholder Protection: It ensures the fair treatment of policyholders and oversees the solvency of insurance companies.

- Market Development: IRDAI works to ensure the growth of the insurance sector, enhancing customer choices and competition.

Insolvency and Bankruptcy Board of India (IBBI)

- Insolvency Regulator: IBBI oversees the processes related to insolvency and bankruptcy under the Insolvency and Bankruptcy Code (IBC), 2016.

- Regulation of Professionals: It regulates insolvency professionals, insolvency professional agencies, and information utilities.

National Housing Bank (NHB)

- Housing Finance Regulator: NHB supervises and regulates housing finance companies, ensuring their financial health and adherence to norms.

- Sector Development: It promotes the housing finance sector by providing financial and other support.

Association of Mutual Funds in India (AMFI)

- Self-Regulatory Organization: AMFI is a self-regulatory organization for the mutual fund industry in India.

- Industry Representation: It represents the mutual fund industry to the government, regulators, and the public.

- Investor Awareness: AMFI conducts investor education and awareness programs to promote mutual fund investments.

Pension Fund Regulatory and Development Authority (PFRDA)

- Pension Sector Regulator: PFRDA regulates the National Pension System (NPS) and other pension schemes to ensure the security and growth of pension funds.

- Investor Protection: It ensures fair play for subscribers to pension schemes and safeguards their interests.

- Market Development: PFRDA encourages the development of a robust pension sector, enhancing financial security in retirement.

Ministry of Corporate Affairs (MCA)

- Corporate Governance: The MCA regulates corporate affairs in India through the Companies Act, ensuring compliance with legal and ethical standards.

- Company Law Administration: It administers the Companies Act and other allied laws, focusing on corporate governance, protection of investor interests, and healthy corporate growth.

Factors Affecting Financial System

- Demand and supply are one of the factors.

- The lack of right and constructive approach to rule-making

- Financial and digital literacy among the people of the nation.

- Monopoly in the market.

- Launching innovative solutions for Supporting public good investments like the unified payments interface (UPI), etc.

52946 Applications Registered for NABARD...

52946 Applications Registered for NABARD...

BOB Apprentice Exam Date 2025 Out, Check...

BOB Apprentice Exam Date 2025 Out, Check...

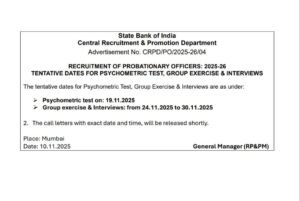

SBI PO Interview 2025 Dates Out, Check C...

SBI PO Interview 2025 Dates Out, Check C...