Q1. Managers should ideally strive to maximize:

(a)Earnings per share

(b)Market price per share

(c)Return on equity

(d)Profit after tax

(e)None of the above

Q2. Prices in terms of purchasing power are called:

(a)Real prices

(b)Nominal prices

(c)Indexed prices

(d)Bid prices

(e)None of the above

Q3. Which of the following is not a specialized Financial Institution?

(a)EXIM Bank

(b)National Bank for Agriculture and Rural Development

(c)Power Finance Corporation

(d)Small Industries Development Bank of India

(e)None of the above

Q4. Net working capital is equal to

(a)Excess of current assets over current liabilities

(b)Excess of long term assets over long term liabilities

(c)Excess of long term liabilities over current assets

(d)Excess of current assets over long term liabilities

(e)None of the above

Q5. Which one of the following is not a current asset as per the Companies Act classification?

(a)Short-term holding of units of mutual fund schemes

(b)Prepaid expenses

(c)Advances to suppliers

(d)Interest accrued on investments

(e)None of the above

Q6. Other things being equal, you will prefer to invest in a company that has

(a)Current ratio more than 1 and debt equity ratio less than 1

(b)Debt equity ratio more than 1 and current ratio less than 1

(c)Both current ratio and debt equity ratio more than 1

(d)Both current ratio and debt equity ratio less than 1

(e)None of the above

Q7. When is a profitability index used?

(a)When capital is rationed

(b)When IRR cannot be used

(c)When IRR and NPV conflict

(d)When payback is deemed to have insufficiently taken into account the time value of money.

(e)None of the above

Q8. In estimating “after-tax incremental operating cash flows” for a project, you should include all of the following EXCEPT:

(a)sunk costs

(b)opportunity costs

(c)changes in working capital resulting from the project, net of spontaneous changes in current liabilities

(d)effects of inflation

(e)Tax rate changes

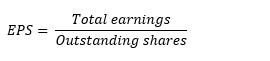

Q9. What are the earnings per share (EPS) for a company that earned $400,000 last year in after-tax profits, has 200,000 common shares outstanding and $1.2 million in retained earnings at the year end?

(a)$400,000

(b)$8.00

(c)$2.00

(d)$6.50

(e)$2.40

Q10. How many undiversified assets are advised to be in a portfolio to achieve maximum reduction of risk?

(a)2 to 10 assets

(b)Maximum possible assets

(c)20 to 30 assets

(d)50 to 60 assets

(e)10 to 20 assets

Solutions

S1. Ans.(a)

Sol. We can say that the objective of a Finance Manager is to increase or maximize the wealth of the owners by increasing the value of the firm which is reflected in its Earnings Per Share (EPS) and the market price of its shares.

S2. Ans.(a)

Sol. Nominal prices or values refer to the economic value expressed in fixed money terms. Real prices or values adjust the nominal value to account for inflation, or changes in the general price level over time. For example, real income will measure the actual purchasing power of the earner

S3. Ans.(c)

Sol. The list of specialized financial institutions in India mainly includes, Export-Import Bank Of India, Board for Industrial & Financial Reconstruction, Small Industries Development Bank of India, National Housing Bank. They are government undertakings established with a view to offer financial as well as technical assistance to the Indian industries.

S4. Ans.(a)

Sol. NetWorkingCapital = (CurrentAssets) – (CurrentLiabilities)

Net working capital (NWC) is the difference between a company’s current assets and current liabilities. A positive net working capital indicates a company has sufficient funds to meet its current financial obligations and invest in other activities.

S5. Ans.(a)

Sol. It is expected to be realised, or is intended for sale or consumption, in the company’s normal operating cycle; or(b) it is held primarily for the purpose of being traded; or

(c) it is expected to be realised within twelve months after the reporting date; or

(d) it is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting date.

Current assets

(a) Current investments

(b) Inventories

(c) Trade receivables

(d) Cash and cash equivalents

(e) Short-term loans and advances

(f) Other current assets

S6. Ans.(a)

Sol. The current ratio and debt equity ratio is a liquidity ratio that measures a company’s ability to pay off their short-term dues with their current assets and long term commitments respectively. Therefore if a company has a high ratio (anywhere above 1) then they are capable of paying their short-term obligations. The higher the ratio is the more capable the company.

The debt ratio for a given company reveals whether or not it has loans and, if so, how its credit financing compares to its assets. It is calculated by dividing total liabilities by total assets, with higher debt ratios indicating higher degrees of debt financing. From a pure risk perspective, lower ratios are considered better debt ratios.

S7. Ans.(a)

Sol. Capital rationing is a technique of selecting the projects that maximize the firm’s value when the capital infusion is restricted. Under capital rationing, we need a method of selecting that portfolio of projects which yields highest possible present value within the available funds. Since the profitability index measures the present value per rupee of outlay, it is considered to be a useful criterion for ranking a set of projects in the order of decreasingly efficient use of capital. Profitability index is equal to

![]()

S8. Ans.(a)

Sol. Sunk costs must be ignored. For example, the cost of existing land must be ignored because money has already been sunk in it and no additional or incremental money is spent on it for the purposes of this project.

S9.Ans.(c)

Sol.

Earningspershare (EPS) = $400,000 / 200,000 = 2.00

S10.Ans.(c)

Sol. Provided assets are truly diversified in the sense of having a low correlation between their returns, the full risk reduction from portfolio diversification can be achieved at around 20 to 30 assets.

Daily Current Affairs 11th July 2025, Im...

Daily Current Affairs 11th July 2025, Im...

Daily Current Affairs 10th July 2025, Im...

Daily Current Affairs 10th July 2025, Im...

Daily Current Affairs 9th July 2025, Imp...

Daily Current Affairs 9th July 2025, Imp...